As we shared in our recent Fall What’s Up, important changes to CSU Travel & Business Expense Policy are coming. The changes will impact all business travel starting on January 1st, 2024.

Reimbursable meals during domestic travel are based on federal GSA rates. Said reimbursements must be associated with an overnight stay. Provided the expenses do not exceed $75, per diem does not require a receipt. The daily per diem for domestic travel ranges from $59 – $79, based on the location and cover daily meals and incidental expenses. Updates to both the SJSU Travel Guide and FABS website will be shared with the campus in January 2024.

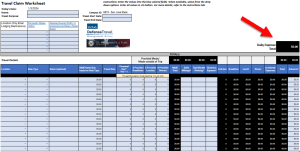

While we work to modify FTS to support the policy changes, all travel reimbursements require the following spreadsheet to be completed and attached to all Travelers Reimbursement Claims.

The CSU Chancellor’s Office created a Travel Claim spreadsheet that automatically loads the daily rates, less the meals provided, for ease in processing. The spreadsheet is designed to assume max per diem is due to the traveler per day, provided it is not the first or last day of travel and there is an overnight stay. First and last days of travel only receive 75% of the per diem totals.

Changes to FTS, Training, and Open Labs will be announced in early January. Please stay tuned! If you have questions, please contact FinanceConnect at financeconnect@sjsu.edu or contact the Payment Services Travel Specialist.