Class Discussion: Student-Managed Fund

BUS 196D

Classroom experience that offers a real return on investment

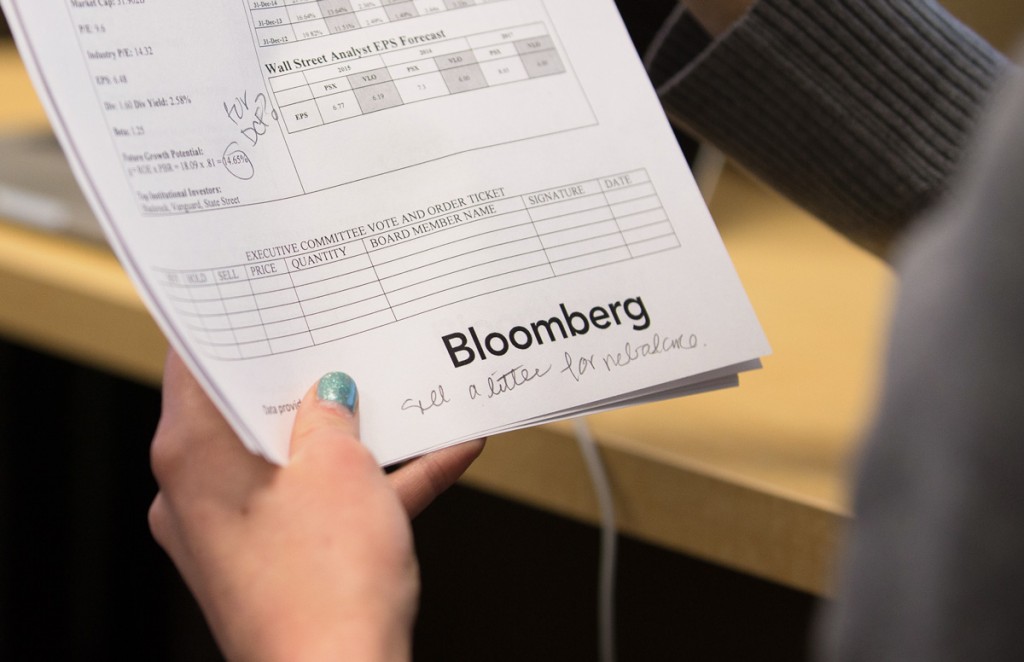

Move over Wall Street. At San Jose State, students get to manage real investments in class. Sitting at 12 Bloomberg terminals, students monitor and analyze real-time financial market data, gathering information they need to manage a $50,000 portfolio. And they’re managing it so well that it consistently generates an investment return that tops the S&P 500.

The Financial Navigator Student-Managed Investment Fund, also known as the Spartan Fund, was established with a $100,000 donation from Nancie Fimbel, and her husband C. Edward Van Deman, CEO of Financial Navigator. Fimbel, who capped a 28-year career at San José State by serving as acting MBA director and senior director of development for the Lucas College and Graduate School of Business, wanted to give back to the university.

Photo: Christina Olivas

“I’m very proud of having started this,” Fimbel says. “I had dreamed of this, and it’s really a kick to see the students pitch to each other.”

A four-student team from SJSU walked away with a first-place trophy at the CFA Institute Investment Research Challenge for the Northern California region earlier this year, beating teams from the Stanford MBA program, the Wharton executive MBA program, Santa Clara University, the University of California, Berkeley, and the University of San Francisco.

Plans are in the works to make Spartan Fund a permanent course, allowing the fund to be managed on a continuous basis throughout the semester and academic year. As the students invest wisely, the fund’s growth and income will benefit both the college and its future students.